SAP S/4HANA Cloud for Treasury and Risk Management

Automate treasury tasks and integrate them with core finance processes to enhance liquidity and mitigate financial risks.

Intelligent Treasury Management in Real Time

SAP S/4HANA Cloud for Treasury and Risk Management is a cloud-based SAP solution for managing finance, treasury, and risk. It helps organizations effectively manage cash and liquidity, forecast cash flows, and identify and manage financial risks. With close integration with other SAP S/4HANA modules and powerful reporting and analytics tools, the solution provides enhanced control over financial resources, minimizes risks, and supports informed financial decision-making.

Unlike its predecessor, SAP Treasury and Risk Management, SAP S/4HANA Cloud for Treasury and Risk Management offers the following:

- All the benefits of cloud architecture, including high performance, real-time data processing, and advanced analytics

- Scalability, flexibility, and regular updates

- Faster and easier deployment without significant capital investments in IT infrastructure

- Integration with new technologies and improved analytics and reporting tools

Key Benefits of SAP S/4HANA Cloud for Treasury and Risk Management

Centralized trading activities

Integration with trading platforms and market data providers

Security

Flexibility

Transparency and control

Treasury integration with core processes

Improved efficiency and process control

Scalability

Cloud deployment

Who Uses This Solution?

Treasury and Liquidity Management

- Head of Treasury

- Treasury Managers

- Treasury Analysts

Finance Department

- Chief Financial Officer (CFO)

- Head of Corporate Finance

- Finance Manager

Risk Management and Compliance

- Risk Manager

- Risk Controller

- Internal Auditor

Key Features

Cash and liquidity management

- Provides real-time visibility into cash positions across various bank accounts and subsidiaries.

- Supports cash forecasting and liquidity planning to optimize cash flow.

- Integrates with bank communication to automatically process bank statements.

Services We Offer

Strategic consulting

SAP implementation

SAP integration

SAP Application Management Services (AMS)

Cloud migration

Security

Integration Capabilities Within the SAP Ecosystem

SAP S/4HANA Cloud for Treasury and Risk Management seamlessly integrates into the broader SAP ecosystem, enabling efficient financial operations through end-to-end connectivity with key SAP solutions.

- SAP Cash Management: Provide real-time visibility into account balances and support accurate liquidity planning.

- SAP Multi-Bank Connectivity: Automate and secure banking transactions with multiple financial institutions.

- SAP Analytics Cloud: Leverage advanced data visualization, KPI tracking, and decision support tools.

- SAP Financial Accounting: Ensure accurate financial postings and alignment between treasury operations and accounting.

- SAP Controlling: Enable cost tracking and analysis of the financial impact on internal reporting and cost control.

- SAP Group Reporting: Facilitate group-level financial consolidation and simplify statutory and management reporting.

Customers’ Success Stories

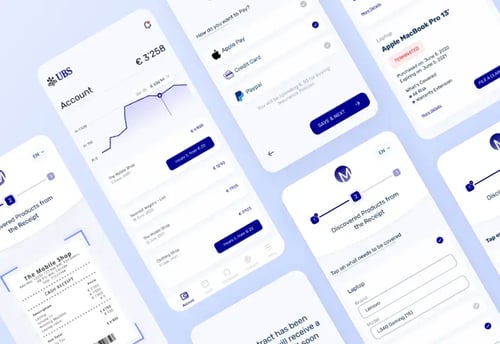

Developing Mobile Solution for a Banking Company

LeverX developed a mobile solution that allowed the banking company to improve customer service and increase customer satisfaction.

Fintech Solution Development for a Group of Banks

LeverX provided the client with several solutions that ensure smooth bank performance in several ways, from providing additional security to facilitating operations and improving revenue growth.

Data science solution development for the fintech sector

Merchant recognition solution based on machine learning.

Industries we serve

Why LeverX?

Proven track record

Industry experts

SAP partnership

Quality and security

Investment in innovation

Flexibility

Implementation Roadmap

- Current Processes Evaluation: Assess existing business processes and identify the organization's needs.

- Defining Technical Requirements: Create a detailed specification of the functional and technical needs of the new system.

Discover

- Setting Goals and Objectives: Establish and agree on the goals to be achieved throughout the project.

- Assembling the Project Team: Appoint team members and define their roles and responsibilities.

- Project Plan Development: Create a comprehensive plan that outlines project phases, timelines, resources, and key performance indicators.

- Budget Determination: Estimate and approve the budget.

- Specifications Preparation: Develop the technical and functional specifications for the development team.

Prepare

- Ensuring Business Requirements are Met: Check that SAP S/4HANA Cloud for Treasury and Risk Management aligns with business requirements and project objectives.

- Data Validation: Verify the accuracy and compliance of the data.

Explore

- Data Migration: Transfer data from existing systems to the new one.

- System Configuration: Set up the solution according to requirements and specifications.

- Customization: Develop additional features and modules, if the standard solution does not meet all needs.

- Integrations: Configure SAP S/4HANA Cloud for Treasury and Risk Management to work with other IT systems and applications.

Realize

- Testing: Perform functional, integration, regression, and load testing to ensure that all works correctly.

- User Training: Organize sessions to help users become familiar with the new system.

Deploy

- System Readiness Check: Verify that the system is ready for operational use.

- Launch: Officially transition to active use of SAP S/4HANA Cloud for Treasury and Risk Management.

- Ongoing Support: Continuously monitor solution performance to identify and resolve any issues.

Run

CONTACT US

If you are looking for an SAP Global Strategic Supplier or Technology Partner for your business, fill out the form below, and we will contact you at short notice.

FAQ

What is SAP S/4HANA Cloud for Treasury and Risk Management?

SAP S/4HANA for Treasury and Risk Management (TRM) is a comprehensive suite of functions within S/4HANA Finance that manages a company's entire debt, investment, and foreign exchange lifecycle. It acts as the central sub-ledger for all financial market transactions, from money market deals to foreign currency hedging. Because it is built on the S/4HANA platform, when a treasurer executes a trade, the corresponding accounting and cash position updates happen automatically and in real time.

What is the difference between Treasury and Risk Management (TRM) and Cash Management?

Is the functionality of the Cloud version different from that of the on-premise version?

The core business functionality of TRM is essentially the same for both SAP S/4HANA Cloud and on-premise deployments. The key differences are in the delivery model: the cloud version is a Software-as-a-Service (SaaS) offering managed by SAP with automatic quarterly updates, while the on-premise version gives you more control over the system landscape and update schedule. Some new innovations may also be released on the cloud version first.

How does the solution support hedge accounting compliance?

The system includes a dedicated Hedge Management and Accounting component specifically designed to support compliance with international accounting standards like IFRS 9 and ASC 815. It allows you to formally document hedging relationships, automate effectiveness testing (e.g., via regression analysis), and generate the required financial postings for your hedging instruments, significantly reducing manual effort and audit risk.

What is the main business case for using the 'In-House Cash' feature?

The primary goal is to optimize liquidity and reduce external banking costs. By creating an "in-house bank," a corporate group can centralize its payments and manage intercompany lending. Subsidiaries with excess cash can lend internally to those that need funds, reducing the need for expensive external short-term loans. This also minimizes the transaction fees paid to commercial banks for intercompany transfers.

Is Treasury and Risk Management included in a standard S/4HANA Finance license?

Contact Us

What happens next?

-

1

An expert will reach out to you to discuss your specific needs and requirements.

-

2

We'll sign an NDA to ensure any sensitive information is kept secure and confidential.

-

3

We'll work with you to prepare a customized proposal based on the project's scope, timeline, and budget.

years of expertise

projects

professionals

Contact Us