SAP S/4HANA Finance for Group Reporting

Streamline financial consolidation and close processes by unifying operational and group reporting.

Faster Financial Close Processes Within the SAP S/4HANA Platform

SAP S/4HANA Finance for Group Reporting is SAP’s next-generation solution for consolidated financial reporting. It empowers companies to streamline group close processes, improve accuracy, and gain real-time insights — all of which support more effective financial management and strategic decision-making.

Embedded directly into the SAP S/4HANA platform, the solution consolidates financial data from multiple entities, such as subsidiaries, divisions, and legal units, in real time. Because it draws information directly from core financial modules, there’s no need for manual data transfers or replication. The consolidated overview is available when the period is closed, enabling faster responses and more transparent reporting.

Here’s how SAP S/4HANA for group reporting differs from legacy tools like SAP Business Planning and Consolidation (SAP BPC):

- Embedded in SAP S/4HANA

Group reporting runs directly within the S/4HANA environment, eliminating the need for data replication or synchronization, unlike SAP BPC, which often operates as a separate system. - Real-time consolidation

Thanks to the in-memory architecture of SAP HANA, financial data is consolidated and reported in real time, enabling quicker period-end close and improved transparency. - Unified master data and reporting logic

Group reporting uses the same master data, transactional data, and reporting structures as S/4HANA Finance, reducing data inconsistencies and reconciliation efforts often required in SAP BPC setups. - Simplified system landscape

By consolidating operations into a single platform, SAP S/4HANA for group reporting reduces system complexity and lowers the total cost of ownership compared to BPC-based multi-system landscapes. - Built-in analytics and compliance tools

The solution includes native support for audit trails, compliance checks, and embedded SAP Analytics Cloud integration for advanced financial planning and reporting — features that typically require additional configuration in SAP BPC.

Benefits of SAP S/4HANA Finance for Group Reporting

Real-time data access

Data integrity

More accurate forecasting

Reduced closing time

Increased transparency

Deployment flexibility

Key Features

Integrated data model

- Consolidates financial data across various entities and subsidiaries within a single, unified system.

- Ensures data consistency and accuracy across the organization.

Flexible reporting standards

- Supports multiple reporting standards, including IFRS, GAAP, and local statutory requirements.

- Allows for customization of reports to meet specific business needs and regulatory requirements.

Automated financial close

- Automates repetitive tasks required in the financial close process.

- Minimizes the risk of errors through automated processes and checks.

Advanced analytics and reporting

- Provides advanced analytical tools for in-depth financial analysis.

- Offers interactive dashboards and visualizations to track financial performance.

Multi-currency support

- Handles transactions and reporting in multiple currencies.

- Automates currency translation and revaluation processes.

Audit trail and compliance

- Maintains a detailed audit trail of all financial transactions and consolidations.

- Ensures compliance with regulatory and audit requirements.

Continuous accounting

- Allows for continuous updates and monitoring of financial data.

- Supports proactive financial management and decision-making.

Collaboration tools

- Facilitates collaboration among finance teams with shared access to data and reports.

- Enables adding comments and annotations to financial data for better context and understanding.

Scenario planning and forecasting

- Utilizes predictive analytics for scenario planning and forecasting.

- Allows users to create and analyze various “what-if” scenarios to assess potential outcomes.

Who Benefits from SAP S/4HANA for Group Reporting?

SAP Group Reporting is the right choice for organizations that manage financial data across multiple legal entities and need to produce consolidated reports for internal or external purposes.

This solution is especially valuable for:

- Holdings and corporate groups that consolidate financials across subsidiaries and business units

- International companies operating under multiple reporting standards, such as IFRS and local GAAP

- Organizations with complex ownership structures requiring transparent and auditable consolidation

- Finance and consolidation teams seeking to automate group close and reduce manual effort

- CFOs and controllers who need accurate, real-time insights for strategic decision-making

- Businesses transitioning from SAP BPC and looking for a modern, embedded consolidation solution

Services We Offer

Strategic consulting

SAP Implementation

SAP Integration

SAP Application Management Services (AMS)

Seamless Integration Across the SAP Ecosystem

SAP S/4HANA for Group Reporting can integrate with various SAP solutions to help businesses unify data flows, ensure consistency, and extend the impact of their financial consolidation processes.

- SAP FI: Ensure timely and accurate financial consolidation by pulling actuals directly from SAP Financial Accounting, reducing manual work, and eliminating reconciliation errors.

- SAP BPC: Leverage existing planning and budgeting models from SAP BPC while transitioning to a real-time consolidation environment, enabling phased modernization without disrupting operations.

- SAP Analytics Cloud: Deliver advanced reporting, visualization, and KPI tracking based on live, consolidated data that empowers leadership with real-time insights and predictive analysis.

- SAP S/4HANA for Central Finance: Consolidate financial information from multiple ERP instances into a unified group-level view, improving transparency and enabling consistent reporting across entities.

- SAP GRC Access Control: Enhance the security and governance of group financial data by managing user roles and access rights, effectively aligning with compliance policies.

- SAP GRC Process Control: Strengthen internal control and compliance monitoring by aligning financial consolidation processes with risk management and audit requirements.

Customers’ Success Stories

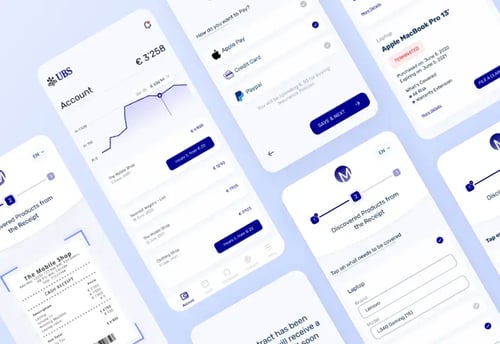

Developing Mobile Solution for a Banking Company

LeverX developed a mobile solution that allowed the banking company to improve customer service and increase customer satisfaction.

Fintech Solution Development for a Group of Banks

LeverX provided the client with several solutions that ensure smooth bank performance in several ways, from providing additional security to facilitating operations and improving revenue growth.

Data science solution development for the fintech sector

Merchant recognition solution based on machine learning.

Industries we serve

Why LeverX?

Proven track record

Industry experts

SAP partnership

Quality and security track record

Investment in innovation

Flexibility

Implementation Roadmap

- Current Processes Evaluation: Assess existing business processes and identify the organization's needs.

- Defining Technical Requirements: Create a detailed specification of the functional and technical needs of the new system.

Discover

- Setting Goals and Objectives: Establish and agree on the goals to be achieved throughout the project.

- Assembling the Project Team: Appoint team members and define their roles and responsibilities.

- Project Plan Development: Create a comprehensive plan that outlines project phases, timelines, resources, and key performance indicators.

- Budget Determination: Estimate and approve the budget.

- Specifications Preparation: Develop the technical and functional specifications for the development team.

Prepare

- Ensuring Business Requirements are Met: Check that SAP S/4HANA Finance for Group Reporting aligns with business requirements and project objectives.

- Data Validation: Verify the accuracy and compliance of the data.

Explore

- Data Migration: Transfer data from existing systems to the new one.

- System Configuration: Set up the solution according to requirements and specifications.

- Customization: Develop additional features and modules, if the standard solution does not meet all needs.

- Integrations: Configure SAP S/4HANA Finance for Group Reporting to work with other IT systems and applications.

Realize

- Testing: Perform functional, integration, regression, and load testing to ensure that all works correctly.

- User Training: Organize sessions to help users become familiar with the new system.

Deploy

- System Readiness Check: Verify that the system is ready for operational use.

- Launch: Officially transition to active use of SAP S/4HANA Finance for Group Reporting.

- Ongoing Support: Continuously monitor solution performance to identify and resolve any issues.

Run

CONTACT US

If you are looking for an SAP Global Strategic Supplier or Technology Partner for your business, fill out the form below, and we will contact you at short notice.

FAQ

What is SAP S/4HANA Finance for group reporting?

This SAP's strategic consolidation solution is designed to replace traditional, batch-oriented closing processes. Instead of extracting data to a separate system, it uses the live transactional data from the S/4HANA Universal Journal. This "continuous accounting" approach allows consolidation tasks to be performed throughout the period, not just at month-end, resulting in a faster, more transparent financial close with a complete audit trail back to the source transaction.

We currently use SAP BPC. What is the recommended path to Group Reporting?

Can Group Reporting consolidate data from subsidiaries not running on SAP?

How does the solution handle complex ownership structures and changes during the year?

What kind of pre-configured content is available to speed up implementation?

Why is the Universal Journal in S/4HANA important for Group Reporting?

Contact Us

What happens next?

-

1

An expert will reach out to you to discuss your specific needs and requirements.

-

2

We'll sign an NDA to ensure any sensitive information is kept secure and confidential.

-

3

We'll work with you to prepare a customized proposal based on the project's scope, timeline, and budget.

years of expertise

projects

professionals

Contact Us