Manage Financial Accounting Data With SAP Finance (FI)

Cover all business facets and reduce operational costs with the top-level financial accounting system.

System That Unlocks Powerful Insights by Competent Financial Data Accounting

SAP Finance (FI) is a core module of the SAP Cloud ERP system, essential for managing financial accounting and preparing statutory reports. It enables organizations to handle all financial transactions in compliance with local and international regulations, ensuring transparency and accuracy in external reporting.

Working together with SAP Controlling (CO), which focuses on internal cost and performance analysis, these two modules form a complete financial management framework. SAP FI handles external financial reporting, while SAP CO supports internal decision-making and cost control, enabling a unified view of your company’s financial health.

What You Can Achieve with SAP Finance

faster period-end close:

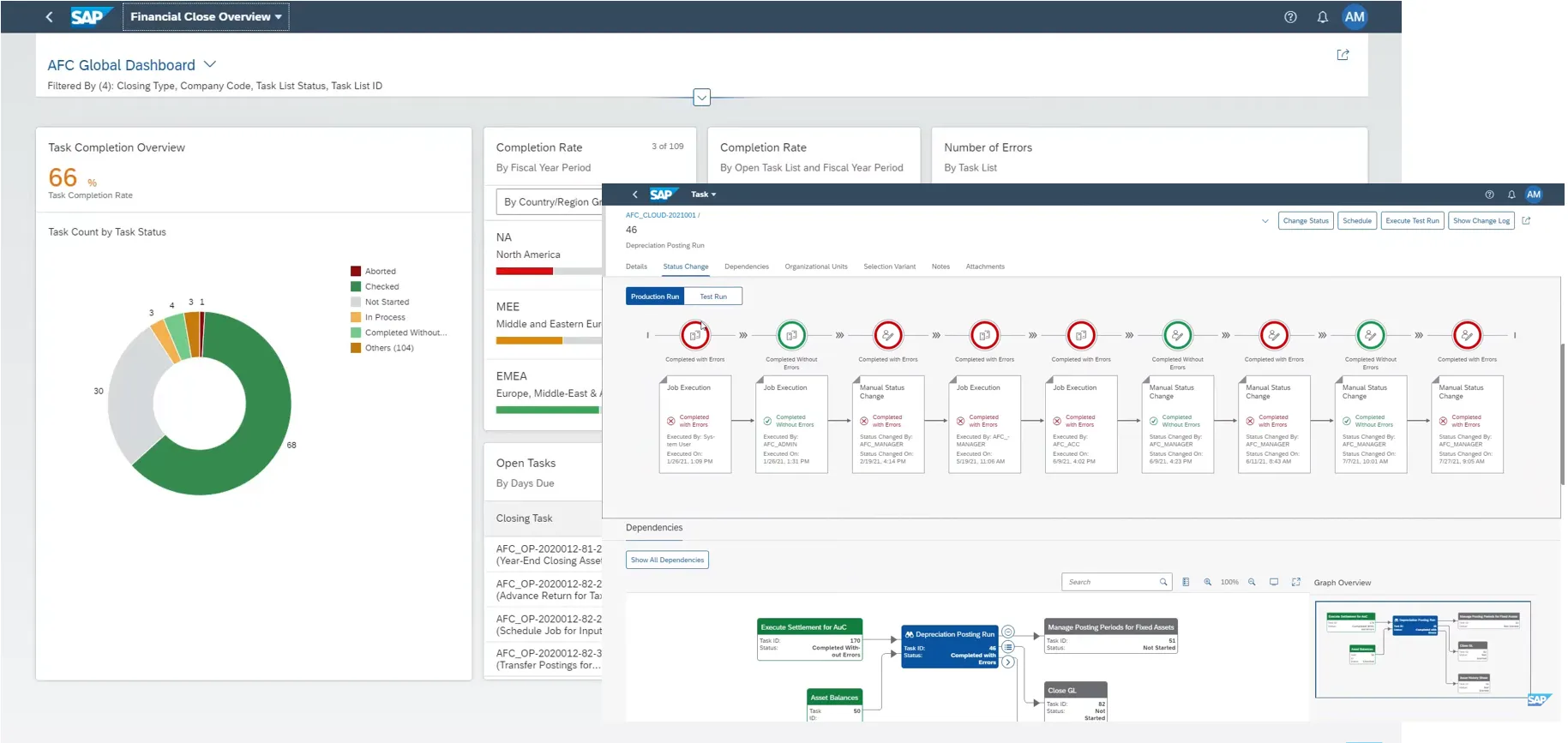

Accelerate closing processes by up to 50% with streamlined workflows and automated tasks.

less time on error correction:

Reduce correction efforts by up to 90% thanks to smart tools that identify and fix issues early.

fewer manual data entry errors:

Minimize the risk of human error by automating data entry and eliminating duplicate or manual processes.

reduction in revenue leakage:

Prevent over 50% of revenue loss with advanced automation and accurate profitability analysis.

Business Benefits of Implementing SAP Finance (FI)

Accelerate period closing by up to 30%

Eliminate manual accounting errors

Automate IFRS and tax reporting

Gain full transparency into receivables and payments

Improve cash flow and working capital

Support strategic decision-making with real-time financial insights

Functional Capabilities of SAP Finance (FI)

Transaction transparency

- Access detailed logs and audit trails for every financial entry

- Ensure traceability and accuracy of data across departments

- Support compliance and reduce the risk of fraud through visible control points

Main Components of SAP Finance (FI)

General Ledger (G/L)

Accounts payable

Accounts receivable

Bank accounting

Asset accounting

Travel management

How SAP Finance (FI) Supports Your Key Business Scenarios

Automate different types of accounting

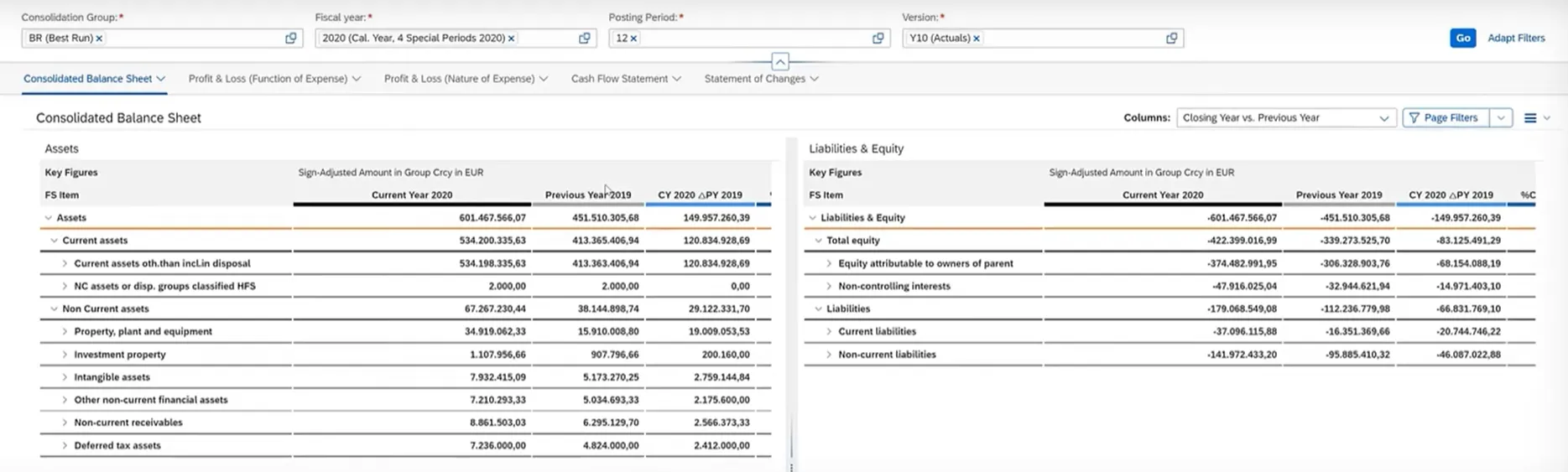

- Maintain national, tax, management, and IFRS/US GAAP accounting simultaneously

- Manage company accounts in multiple parallel currencies and charts of accounts

- Optimize routine and repetitive operations

Explore SAP Finance (FI) solutions to strengthen your business today and lead with confidence tomorrow

How We Can Help

Consulting

Implementation

Integration

Support

Cloud migration

Finance That Works in Sync with Your Business

SAP FI can work in a unified ecosystem with other SAP solutions to ensure seamless data flow and consistent financial operations. The solution can be integrated with various modules to provide end-to-end visibility and automation across key business processes. Here are some common examples:

- SAP CO: Supports budgeting, internal cost tracking, and profitability analysis. Integration with FI allows businesses to align actual financial results with planned values and analyze performance by departments, products, or projects.

- SAP MM: Handles purchasing processes and stock movements. Integration ensures that goods receipts and vendor invoices are automatically reflected in financial accounting, which improves accuracy in expense recognition and supplier payments.

- SAP SD: Manages sales orders, pricing, and billing. When integrated with FI, it enables automatic creation of accounting entries from invoices and payment processing, ensuring accurate revenue recognition and streamlined customer account management.

- SAP Asset Accounting: Covers the complete lifecycle of fixed assets, from acquisition and capitalization to depreciation and disposal. Integration with FI ensures that all asset-related financial transactions are accurately reflected in the general ledger and financial reports.

- SAP Analytics Cloud: Provides real-time dashboards, ad hoc reporting, and forecasting tools. When connected to SAP FI, it helps finance teams analyze actuals, compare performance across periods, and build data-driven financial plans.

Industries We Serve

Why Choose LeverX as Your SAP Implementation Provider?

Proven track record

Industry experts

SAP partnership

Quality and security

Investment in innovation

Flexibility

Implementation Roadmap

- Current Processes Evaluation: Assess existing business processes and identify the organization's needs.

- Defining Technical Requirements: Create a detailed specification of the functional and technical needs of the new system.

Discover

- Setting Goals and Objectives: Establish and agree on the goals to be achieved throughout the project.

- Assembling the Project Team: Appoint team members and define their roles and responsibilities.

- Project Plan Development: Create a comprehensive plan that outlines project phases, timelines, resources, and key performance indicators.

- Budget Determination: Estimate and approve the budget.

- Specifications Preparation: Develop the technical and functional specifications for the development team.

Prepare

- Ensuring Business Requirements are Met: Check that SAP FI aligns with business requirements and project objectives.

- Data Validation: Verify the accuracy and compliance of the data.

Explore

- Data Migration: Transfer data from existing systems to the new one.

- System Configuration: Set up the solution according to requirements and specifications.

- Customization: Develop additional features and modules, if the standard solution does not meet all needs.

- Integrations: Configure SAP FI to work with other IT systems and applications.

Realize

- Testing: Perform functional, integration, regression, and load testing to ensure that all works correctly.

- User Training: Organize sessions to help users become familiar with the new system.

Deploy

- System Readiness Check: Verify that the system is ready for operational use.

- Launch: Officially transition to active use of SAP FI.

- Ongoing Support: Continuously monitor solution performance to identify and resolve any issues.

Run

FAQ

What is SAP Finance (FI)?

What is the key difference between SAP FI in the old ERP (ECC) and in SAP S/4HANA?

Is SAP FI only for large, multinational corporations?

What makes the period-end closing process faster in SAP FI?

How does SAP FI integrate with Treasury functions?

Contact Us

What happens next?

-

1

An expert will reach out to you to discuss your specific needs and requirements.

-

2

We'll sign an NDA to ensure any sensitive information is kept secure and confidential.

-

3

We'll work with you to prepare a customized proposal based on the project's scope, timeline, and budget.

years of expertise

projects

professionals

Contact Us

CONTACT US

If you are looking for an SAP Global Strategic Supplier or Technology Partner for your business, fill out the form below, and we will contact you at short notice