SAP Tax Compliance

Streamline and automate tax compliance checks to reduce risks and potential tax issues

Rapid calculation of tax liabilities and compliance for indirect taxes

SAP Tax Compliance is a solution that helps businesses manage tax control and compliance processes. It automates tax audits using predefined rules and scenarios to help verify the correctness and completeness of tax data and documents. The solution identifies and classifies potential tax risks and provides analysis and reports on these risks.

Continuous monitoring of transactions and operations ensures compliance with tax requirements and adaptation to changes in tax laws. The solution integrates with internal and external systems to collect and analyze data, while also maintaining documentation and audit logs. SAP Tax Compliance provides detailed reports and analytical summaries of tax audit results and uses analytical tools to evaluate the effectiveness of tax control.

Benefits of SAP Tax Compliance

Optimized tax control management

Automated screening

Machine learning capabilities

Increased quality of tax data

Compliance cost minimization

Consolidation of tax compliance activities

Key features

Automated tax calculation

- Automates the calculation of taxes to ensure accuracy and consistency.

- Updates regularly to reflect changes in tax laws and regulations.

Tax reporting

- Generates detailed tax reports for various jurisdictions.

- Ensures that reports meet the requirements of tax authorities.

Data integration

- Integrates with other SAP modules like SAP ERP and SAP S/4HANA, providing a single source of truth for tax-related data.

- Enables real-time processing and reporting of tax data.

Tax determination and jurisdiction handling

- Supports tax determination for multiple jurisdictions and tax types (e.g., VAT, GST, sales tax).

- Configures tax rules and rates based on specific business needs and legal requirements.

Compliance monitoring

- Maintains a detailed audit trail of all tax-related transactions and changes.

- Provides alerts and notifications for potential compliance issues.

Advanced analytics

- Offers advanced analytics and reporting tools to analyze tax data and identify trends or anomalies.

- Features customizable dashboards for monitoring tax compliance status and KPIs.

Integration with external systems

- Supports integration with external systems and tax authorities for seamless data exchange.

- Can be integrated with third-party applications for enhanced functionality.

Risk management

- Identifies and assesses tax compliance risks.

- Provides tools and strategies to mitigate identified risks.

Security and compliance

- Ensures data security through robust encryption and access control mechanisms.

- Complies with various regulatory standards for data protection and privacy.

SAP Services We Offer

SAP Consulting

SAP implementation

SAP Integration

SAP Application Management Services (AMS)

Compatibility with local tax regimes

SAP Tax Compliance handles various types of taxes, including:

- VAT (Value Added Tax)

- GST (Goods and Services Tax)

- CIT (Corporate Income Tax)

- WHT (Withholding Tax)

Our solution is compatible with jurisdiction-specific rates, exemptions, and rules, allowing for accurate tax calculation, reporting, and audit.

Customers’ Success Stories

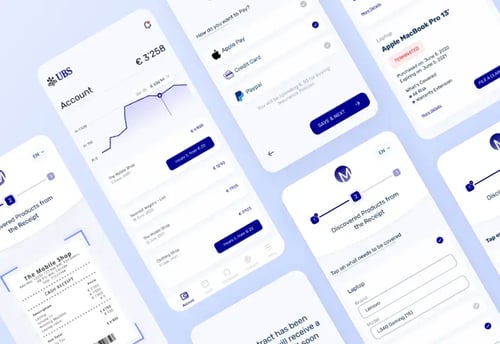

Developing Mobile Solution for a Banking Company

LeverX developed a mobile solution that allowed the banking company to improve customer service and increase customer satisfaction.

Fintech Solution Development for a Group of Banks

LeverX provided the client with several solutions that ensure smooth bank performance in several ways, from providing additional security to facilitating operations and improving revenue growth.

Data science solution development for the fintech sector

Merchant recognition solution based on machine learning.

Integration Capabilities of SAP Tax Compliance

To ensure comprehensive tax management, SAP Tax Compliance can integrate with some other SAP modules across different lines of business.

- SAP FI (Financial Accounting): Leverage financial data about company transactions to verify tax amounts and calculations; reconcile statutory with management accounting.

- SAP MM (Materials Management): Manage VAT on purchases and analyze the tax obligations of the supply chain.

- SAP SD (Sales and Distribution): Monitor sales taxes and potential compliance issues in domestic and export transactions.

- SAP GTS (Global Trade Services): Align foreign trade data with tax liabilities and ensure customs compliance.

- SAP GRC (Governance, Risk and Compliance): Define tax control rules and policies, initiate investigations, and centralize compliance oversight.

- SAP DRC (Document and Reporting Compliance): Automate e-invoicing, SAF-T, KSeF, and other electronic reporting formats; submit electronic reports directly to tax authorities.

- SAP SAC (Analytics Cloud): Visualize tax risks, identify violations, and measure audit performance with interactive dashboards.

Industry overview

Building on our SAP experience and extensive industry expertise, we help you select solutions that create sustainable and long-term value for your company.

Why LeverX?

Proven track record

Industry experts

SAP partnership

Quality and security

Investment in innovation

Flexibility

Implementation Roadmap

We follow the SAP Activate methodology, which divides the implementation of SAP Tax Compliance into six essential phases:

- Current processes evaluation: Assess existing business processes and identify the organization's needs.

- Defining technical requirements: Create a detailed specification of the functional and technical needs of the new system.

Discover

- Setting goals and objectives: Establish and agree on the goals to be achieved throughout the project.

- Assembling the project team: Appoint team members and define their roles and responsibilities.

- Project plan development: Create a comprehensive plan that outlines project phases, timelines, resources, and key performance indicators.

- Budget determination: Estimate and approve the budget.

- Specifications preparation: Develop the technical and functional specifications for the development team.

Prepare

- Ensuring business requirements are met: Check that SAP Tax Compliance aligns with business requirements and project objectives.

- Data validation: Verify the accuracy and compliance of the data.

Explore

- Data migration: Transfer data from existing systems to the new one.

- System configuration: Set up the solution according to requirements and specifications.

- Customization: Develop additional features and modules, if the standard solution does not meet all needs.

- Integrations: Configure SAP Tax Compliance to work with other IT systems and applications.

Realize

- Testing: Perform functional, integration, regression, and load testing to ensure that all works correctly.

- User training: Organize sessions to help users become familiar with the new system.

Deploy

- System readiness check: Verify that the system is ready for operational use.

- Launch: Officially transition to active use of

- Ongoing support: Continuously monitor solution performance to identify and resolve any issues.

Run

CONTACT US

If you are looking for an SAP Global Strategic Supplier or Technology Partner for your business, fill out the form below, and we will contact you at short notice.

FAQ

What is SAP Tax Compliance?

Think of it as a specialized, automated audit assistant that works 24/7 inside your SAP system. Its primary function is proactively checking transactions against a central set of tax rules before they become problems. Instead of finding errors during periodic reviews, it flags potential risks in real time, allowing tax and finance teams to focus only on the exceptions that require human expertise.

What makes SAP Tax Compliance different from traditional tax control tools?

SAP Tax Compliance combines real-time data access, advanced analytics, and rule-based automation in one integrated solution. Unlike traditional tax control tools that work retrospectively, this solution enables proactive risk detection and decision-making within the daily transaction flow.

What types of users can work with SAP Tax Compliance?

Tax managers, internal auditors, compliance officers, and finance analysts typically use the solution. It’s also helpful for IT administrators who manage SAP integrations and ensure that tax data flows correctly between systems.

How does the solution handle frequent changes in tax laws and regulations?

The solution uses a two-pronged approach. First, SAP provides updates for major regulatory changes that can be implemented into the system. Second, and more importantly, it features a flexible rule engine designed for business users. This allows your internal tax experts to quickly create, test, and deploy new rules to adapt to specific local legislation or internal policies without long IT development cycles.

Does SAP Tax Compliance require our company to be on SAP S/4HANA?

While SAP Tax Compliance is optimized for the real-time data architecture of SAP S/4HANA, it is also compatible with older versions like SAP ECC 6.0 (Enhancement Package 6 or higher). The implementation path may vary, so a technical assessment is recommended to ensure seamless integration with your existing landscape.

How is SAP Tax Compliance different from SAP Document and Reporting Compliance (DRC)?

They are complementary solutions that serve different purposes. SAP Tax Compliance is an internal control and risk detection tool. It focuses on monitoring transactions inside your company to ensure they are correct and compliant before reporting. SAP DRC is an external reporting tool. It takes validated data and ensures it is formatted and submitted correctly to government platforms (e.g., for e-invoicing or SAF-T), focusing on the final legal reporting step.

Is this solution designed for tax experts, or does it require significant IT involvement to operate?

It is built specifically for business users like tax managers, compliance officers, and financial analysts. While the initial setup and integration require IT support, daily operations—such as adjusting rules, managing alerts, and running analyses—are performed through user-friendly interfaces and customizable dashboards that do not require technical programming skills. This empowers the tax department to directly manage tax compliance.

Contact Us

What happens next?

-

1

An expert will reach out to you to discuss your specific needs and requirements.

-

2

We'll sign an NDA to ensure any sensitive information is kept secure and confidential.

-

3

We'll work with you to prepare a customized proposal based on the project's scope, timeline, and budget.

years of expertise

projects

professionals

Contact Us