Discover how SAP financial solutions help enterprises optimize financial operations, ensure compliance, and enhance ROI.

SAP offers a comprehensive suite of enterprise financial solutions designed to accomplish various tasks, from accounting functions to financial risk analytics. If you wonder where to start and which tools will bring the most value to your organization, we are eager to guide you through the SAP universe of financial management. In this blog post, we will outline the core SAP finance solutions, explain the benefits they bring and to whom, as well as provide several use cases that will help answer whether SAP financial management is worth it.

Navigating SAP Finance Solutions

SAP financial management software is built on the SAP S/4HANA core and reinforced by SAP Business Technology Platform (SAP BTP). It means the suite covers both transactional and analytical aspects of enterprises’ financial operations. Some of the suite solutions, like SAP S/4HANA Finance for Group Reporting, are natively embedded within the S/4HANA core, while others, like SAP PaPM, run on SAP BTP to provide modeling capabilities that integrate with core data.

SAP S/4HANA for Central Finance

SAP S/4HANA for Central Finance consolidates master, transactional, analytical, and other financial data from SAP and third-party ERP systems. This is very convenient for companies that want to have their financial data unified, but aren’t yet ready to completely migrate to SAP S/4HANA.

The module encompasses the following functional areas:

- Centralizing management and accounting: Consolidating SAP and third-party data, replicating financial accounting and controlling postings, harmonizing master data, providing intercompany reconciliation and eliminations.

- Consolidating financial execution processes for several legal entities: Centralizing financial close, payment processing, tax reporting, compliance, asset accounting, collecting receivables, and resolving customer payment issues.

- Unifying near-real-time analytics: Providing financial performance data, global cash management, profitability analysis, and other types of financial reporting.

Embedded dashboards

- Executive dashboards: a consolidated view of financial performance.

- Controller dashboards: intercompany activities, reconciliation processes, and journal postings.

- Compliance dashboards: audit trail monitoring, visualizing task status, and tracking data flows;

- Treasury dashboards: bank balance, cash positions, and liquidity forecasts.

The SAP Central Finance module provides several benefits to its users.

A comprehensive vision of financial operations

The module provides centralized analytics and reporting by utilizing the central Universal Journal and the in-memory capabilities of S/4HANA. Moreover, it can be integrated with SAP Analytics Cloud (SAC) for planning and other tools to benefit from various reports. Achieve and maintain consistency for better strategic solutions.

A confident step towards standardization and report readiness

The various data in different systems are automatically processed and standardized, which facilitates further group reporting. Data stays traceable and auditable, minimizing errors related to its harmonization.

A safer path for SAP transition

Since the module allows using both SAP and non-SAP financial data source systems to centralize and harmonize all the data, it’s a convenient way to start using SAP S/4HANA Finance without the investment that might seem risky at first. Keep your processes going as long as you need them, gradually moving financial operations to SAP.

The implementation of the module can be completed in around 6-12 months, depending on the project scope, data complexity, and the size of the organization. As a rule, the first beneficial results can be noticed during the first 3-4 months following initial implementation.

SAP Profitability and Performance Management (SAP PaPM)

SAP Profitability and Performance Management (SAP PaPM) creates virtual models you can use to break down different business scenarios and anticipate the direction of future financial operations. The SAP PaPM profitability driver modeling is an opportunity to predetermine which markets, products, sales channels, and customers are more profitable and what affects those components.

The module delivers the following functionality:

- Performance analysis: Implementing diverse scenarios to analyze how new initiatives and potential price and process changes would affect profitability.

- Cost simulation: Applying formulas and rules to define how costs can be distributed across products, regions, customers, and other dimensions.

- Integrated business planning: Combining financial and non-financial metrics and factors to identify what influences profitability and what costs are created.

Embedded dashboards

- Performance dashboards: a compiled view of ROI, margin percentage, operating cost ratio, and other KPIs.

- Profitability dashboards: product, customer, and channel analysis, cost drivers, and margin contribution visibility.

- Modeling dashboards: simulations to analyze the impact of changes in demand, pricing, and costs.

- Planning dashboards: adjustment of financial and operational planning.

SAP PaPM affords several advantages to enterprises that adopt it.

Deeper dive into business performance

The module helps connect operational and financial data, which uncovers more sources of loss and profit, helping identify what affects performance and enables the ability to allocate resources better.

Scenario simulation for informed decisions

Simulate changes in production costs, pricing, or demand to see how profitability would change. Multiple business scenarios can help you test emerging initiatives and anticipate results before taking real actions.

Dynamic cost allocation

SAP PaPM provides an option to use customized formulas and rules for a more flexible cost allocation, improving general accuracy and transparency.

Flexible planning environment

The combination of financial and non-financial information within a single framework helps enterprises understand the connection between planning and performance. You can also integrate the module with SAP Analytics Cloud (SAC) to get more insights about planning, budgeting, and reporting.

The module’s standard implementation can take between 6-10 months, depending on data model complexity, business scenarios to be created, and integrations with other systems.

SAP S/4HANA Finance for Group Reporting

SAP S/4HANA Finance for Group Reporting is an indispensable solution for organizations that work with data from several entities. It facilitates group reporting while maintaining compliance with accounting standards.

The module’s functionality covers the whole reporting cycle:

- Data aggregation and validation: collecting data from SAP and side sources, ensuring its accuracy.

- Automated reconciliation: eliminating manual reconciliation and minimizing errors.

- Consolidation support: following international (GAAP, IFRS) and local standards, maintaining transparency of data operations.

- Real-time analytics: providing prompt access to balance sheets, financial statements, and reports.

Embedded dashboards

- Executive dashboards: consolidated data on revenue, equity positions, margins, and more.

- Controller dashboards: transparent display of reconciliation, consolidation, and intercompany issues.

- Performance dashboards: group result analysis and reporting, KPI monitoring.

- Compliance dashboards: monitoring of validation, audit adjustments, and consolidation.

The module can be useful for covering a wide range of group reporting needs.

Consolidated reporting

Group reporting happens within SAP S/4HANA in real time. There is no need for separate data transfers or consolidation solutions.

Reduction of manual operations

The module streamlines data validation, consolidation, and intercompany eliminations. The automation helps mitigate compliance risks and shorten the close period.

Compliance with accounting standards

SAP S/4HANA for Group Reporting provides built-in rules for transparent reporting and compliance with various standards, without compromising data consistency.

A standard module implementation can take 6-9 months, considering such factors as the complexity of consolidation, the number of entities involved, and data integration needs.

S/4HANA Cloud for Cash Management

S/4HANA Cloud for Cash Management is an opportunity to keep real-time visibility of liquidity flows, which is important for cash position management, liquidity forecasts, and decision-making.

The solution empowers its users to perform the following operations:

- Cash balance monitoring: tracking various cash data in real time.

- Cash flows forecasting: projecting liquidity flows according to such conditions as payment schedules and financial transactions.

- Bank data management: enabling signatory control, supporting audit readiness, and ensuring account lifecycle administration.

- Operation automation: reducing manual cash operations.

- In-depth analytics: processing the data on forecasted and historical liquidity positions for further planning.

Embedded dashboards

- Treasury dashboards: bank balances, cash positions, and liquidity gaps.

- Bank management dashboards: fees, signatories, utilization rates, and active accounts.

- Cash forecasting dashboards: potential short- and long-term cash flows.

- Working capital dashboards: payables, receivables, and net working capital analytics.

Those who use the module appreciate its different advantages.

Prompt visibility

You can keep up with the latest updates on cash and its equivalents across all entities and parties. It’s a legitimate way to improve cash utilization and decision-making.

Forecast accuracy

Embedded predictive analytics improves the accuracy of liquidity forecasts, minimizing the associated risks.

Process reliability

Automated cash positioning and reconciliation minimize the risk of human error.

The implementation of this module can take 4-8 months, with the first results available within 2-3 months after deployment.

SAP S/4HANA Cloud for Treasury and Risk Management

SAP S/4HANA Cloud for Treasury and Risk Management is a unified solution for treasury operation control, liquidity maintenance, and financial risk minimization. Everything happens transparently and in compliance with international regulations.

The module contains the following functionality:

- Hedge management and accounting: automating hedge processes, while keeping them compliant with international standards.

- Transaction support: managing the full cycle of bonds, loans, securities, and other financial instruments.

- Risk analytics: exploring potential risks regarding interest rates, currency exchange, and market volatility.

- Reporting: preparing documentation for audits, disclosure statements, and reports.

Embedded dashboards

- Risk exposure dashboards: FX hedging analysis, interest rate fluctuations, and commodity risks.

- Treasury operations dashboards: investment portfolios, cash positions, and funding requirements.

- Hedge management dashboards: regulatory compliance monitoring, accounting results, and hedge effectiveness data.

- Performance dashboards: evaluation of financial instruments, liquidity coverage, and risk-adjusted returns on capital.

Companies and financial departments highlight various benefits they discovered after the implementation of the module.

Simplified valuation processes

It becomes easier to follow global and local standards for hedge documentation. Reducing manual processing of data entry and financial transactions minimizes operational risks.

Valuable insights for investment planning

Embedded analytics improves the understanding of market conditions and portfolio performance. Intelligent recommendations help make investment decisions more sophisticated.

Data consistency across financial solutions

The module seamlessly connects with SAP S/4HANA Finance layers, which improves financial and liquidity planning, keeping the risks under control.

Organizations typically implement the module within 6-9 months and observe the initial results within the first 3-4 months after the initial implementation.

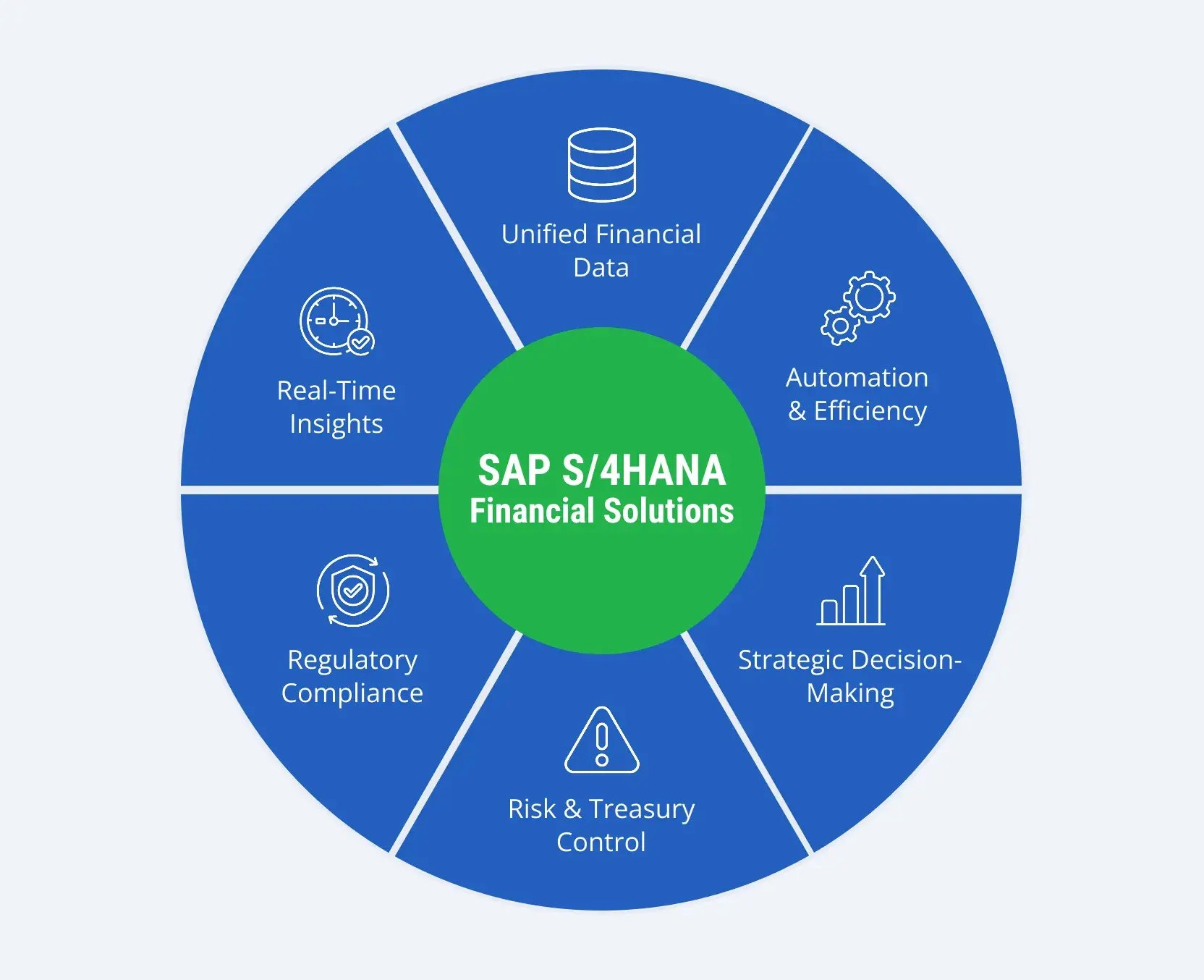

Benefits of Using SAP Financial Solutions

Various specialists can benefit from financial SAP solutions in different ways.

| Role | Challenges | SAP Finance Modules That Bring Value | Solutions | KPIs |

| Chief Financial Officer (CFO) |

|

|

|

|

| Chief Information Officer (CIO) |

|

|

|

|

| Financial Planning & Analysis Lead |

|

SAP Profitability and Performance Management |

|

|

| Chief Accountant, Controller |

|

|

|

|

| Treasurer |

|

|

|

|

SAP Finance Benefits in Action: Five Stories From the Real World

When businesses implement SAP financial products, they usually observe measurable benefits. Much depends on an implementation partner, of course. Let’s consider several examples of successful SAP intercompany automation, financial close management, and other advantages after the solutions were adopted.

Consolidating financial data with SAP S/4HANA for Central Finance

An international provider of industrial components with more than 20 subsidiaries used multiple ERP systems. The company continued to grow, and financial data consolidation became more complicated, making it hard to report on and take action. The company adopted SAP S/4HANA for Central Finance to connect SAP and non-SAP financial systems into a single hub. This way, they got near-real-time data replication and a centralized data structure, resulting in up to 70% faster month-end closings and confidence to move forward.

Gaining visibility into profit drivers with SAP Profitability and Performance Management (SAP PaPM)

A European dairy manufacturer faced difficulties with identifying profitable local markets. The reason was clear: its financial team used static data and spreadsheets, which slowed down profitability analysis. When the company implemented SAP Profitability and Performance Management (SAP PaPM) and integrated it with the existing SAP S/4HANA system, the financial team started using real-time simulations, based on the combination of the latest operational and financial data. As a result, they shortened decision cycles by about 40% and improved profitability margins.

Facilitating financial consolidation with SAP Group Reporting

An international provider of renewable energy with a dozen subsidiaries tried to manage financial consolidation across disparate ERP systems. Each monthly financial close entailed manual reconciliation and adjustments in Excel, which hindered general reporting. The company started using SAP Group Reporting to combine real-time financial data from various sources, automate currency translations, and perform intercompany eliminations. The solution helped the company reduce its consolidation cycle by around 45% and improve visibility with compliance across the subsidiaries.

Optimizing liquidity planning with SAP Cash Management

An electronics supplier with factories in Asia and Europe had issues with tracking cash positions across its banking partners and subsidiaries. The company did it manually, which resulted in a limited data view and slowed forecasting. Then the company embraced SAP S/4HANA Cash Management to gather bank account information, cash positions, and liquidity forecasts within one interface. This move allowed the company to improve forecast accuracy by 21%, eliminate manual reconciliation, and achieve the needed visibility into global liquidity.

Protecting against currency fluctuations with SAP Treasury and Risk Management

An international mining and metals company handled complex financial instruments and global operations. Since commodity prices and exchange rates constantly fluctuate, the company began considering ways to improve its control over treasury operations. With SAP Treasury and Risk Management, the company consolidated all treasury operations, automated the recording of financial transactions, and could determine the market value of financial instruments. As a consequence, the organization made its hedge accounting processes approximately 27% faster and obtained transparency of treasury positions to safeguard profitability.

Why LeverX Should Become Your Partner of Choice for Maximizing SAP Finance ROI

LeverX has over 20 years of experience working with SAP solutions. We were honored to become an SAP Strategic Supplier and Gold Partner, confirming the level of our expertise. Our company has a global presence in Europe, the U.S., the Middle East, and Central Asia, which gives us an opportunity to deep dive into international and local financial processes, the specifics of taxation, accounting, and reporting. We also work closely with various industries, delving into their specific processes and workflows. This knowledge, together with a deep understanding of SAP financial solutions, makes us a trusted strategic partner for companies that want to reduce days to close with SAP, consolidate their financial data, optimize planning, decision-making, and more.

FAQ: What Else You Might Want to Know

It’s fair enough that we shouldn’t limit ROI calculations just to direct cost reductions. The implementation of SAP Finance brings both tangible and intangible advantages. So, to define the actual strategic value of the software, not only its operational efficiency, you should do the following:

- Evaluate measurable results, including reduced audit expenses, shortened days to close, and decreased manual workload.

- Analyze potential losses that you managed to avoid with the financial software from SAP.

- Add the extra, positive outcomes from SAP Finance, such as prompt decision-making, improved liquidity control, or improved compliance.

The level of accuracy depends on several factors:

- The quality of your financial data.

- Model setup, including forecast horizons, data sources, and uncertainty treatment.

- Prolonged model refinement.

An experienced SAP integrator can ensure a best-practice setup so that your forecast accuracy can remain high.

When examining SAP RAR vs. BRIM, you might discover that both solutions support revenue processes. However, they address different stages of this process. SAP Revenue Accounting and Reporting (SAP RAR) is used to manage the accuracy of income records and automate revenue allocation and timing in financial statements. As for SAP Billing and Revenue Innovation Management (SAP BRIM), it is focused on ways to generate and bill revenue, such as providing personalized subscriptions, pay-per-use pricing, and bundled services.

You can use both solutions in combination, covering the commercial and financial aspects of revenue management.

How useful was this article?

Thanks for your feedback!